Long Call Options in Options Trading

Last Updated: Mar 13, 2025

In the world of options trading, long call options offer a powerful strategy to profit from upward movements in the stock market. When you purchase a long call option, you gain the right—but not the obligation—to buy 100 shares of the underlying stock at a predetermined strike price before expiration. This approach provides significant leverage, allowing you to control a large position with a relatively small investment.

Before diving deeper into long call options, it’s important to understand some basic terminology:

Before diving deeper into long call options, it’s important to understand some basic terminology:

- In-The-Money (ITM): The stock price is greater than the strike price.

- At-The-Money (ATM): The stock price is equal to the strike price.

- Out-of-the-Money (OTM): The stock price is less than the strike price.

The Goal of Long Call Options

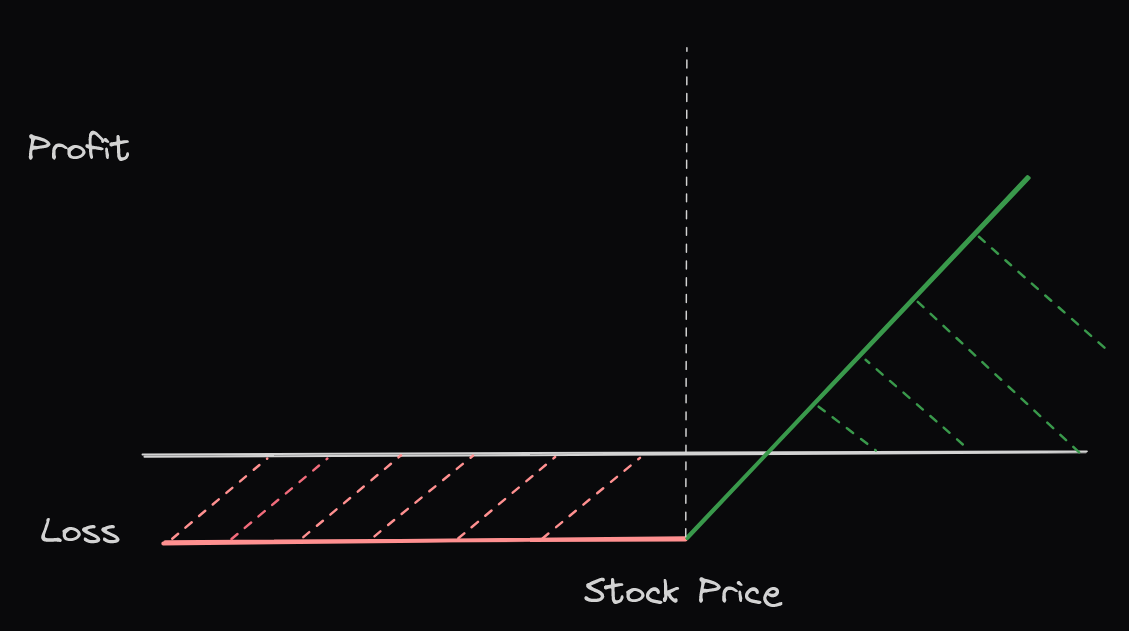

The primary goal when trading long call options is to reach a favorable break-even point. To profit, the underlying stock price must exceed the sum of the strike price and the premium paid. For instance, if you pay $5.00 for an option with a strike price of $100, the stock must rise above $105 for the trade to be profitable.

In options trading, this means you’re betting on a significant upward movement to not only cover the cost of the option but to generate a meaningful return. Without a robust move in the stock, the risk of loss remains high.

In options trading, this means you’re betting on a significant upward movement to not only cover the cost of the option but to generate a meaningful return. Without a robust move in the stock, the risk of loss remains high.

Impact of Time on Long Call Options

One of the key challenges in options trading is managing time decay, or theta decay. As the expiration date approaches, the time value of long call options diminishes rapidly—especially if the option remains out-of-the-money.

Early in the option’s life, time decay is less severe. However, in the final weeks or days before expiration, the loss of time value accelerates. Even if the underlying stock is moving upward, insufficient movement may not overcome this decay, thereby reducing your overall profit potential.

Early in the option’s life, time decay is less severe. However, in the final weeks or days before expiration, the loss of time value accelerates. Even if the underlying stock is moving upward, insufficient movement may not overcome this decay, thereby reducing your overall profit potential.

Volatility and Its Role in Options Trading

Volatility is another critical factor that affects long call options. In options trading, increased implied volatility usually raises the premium, reflecting a greater chance of significant price swings. Events such as earnings announcements can spike demand for options, pushing up their cost.

However, once the event has passed, implied volatility often drops sharply. This sudden collapse can decrease the option’s value, even if the underlying stock’s price has risen. Successful options traders must balance the benefits of high volatility with the risks it introduces.

However, once the event has passed, implied volatility often drops sharply. This sudden collapse can decrease the option’s value, even if the underlying stock’s price has risen. Successful options traders must balance the benefits of high volatility with the risks it introduces.

Pros of Long Call Options

- High Leverage: Long call options require a smaller investment compared to buying 100 shares outright, allowing for substantial exposure to market moves.

- Unlimited Profit Potential: Similar to owning the underlying stock, there is no cap on the profits if the stock price surges.

- Defined Risk: Your maximum loss is limited to the premium paid, offering a safer alternative compared to strategies with unlimited downside.

Cons of Long Call Options

- Time Decay: If the stock does not move significantly, the option can lose value quickly as expiration nears.

- High Sensitivity to Price Movement: Even a small downward movement in the stock can adversely affect the value of a long call option, increasing the risk.

A Practical Example of Long Call Options

To illustrate how long call options work in options trading, consider the following example:

Imagine you purchase a call option with a strike price of $100 for a premium of $5. At expiration, the intrinsic value of the option is determined by the formula:

Imagine you purchase a call option with a strike price of $100 for a premium of $5. At expiration, the intrinsic value of the option is determined by the formula:

Option Price = max(Stock Price - Strike Price, 0)

If the stock price rises to $110, the intrinsic value is $10 per share. After subtracting the $5 premium, your profit is $5 per share. The break-even point is reached when the stock price equals:

Break-Even = Strike Price + Premium

This example underscores how long call options require a significant move in the stock to overcome the cost of the option and generate profit.

Conclusion

In conclusion, long call options are a vital part of any options trading strategy. They offer the potential for high returns through leveraged exposure while keeping risk limited to the premium paid. By understanding key factors such as time decay, volatility, and the break-even point, you can better navigate the complexities of the options market. Whether you are new to options trading or a seasoned investor, mastering long call options can help you make more informed trading decisions and capitalize on market opportunities.