UBS ETRACS CMCI Food Tota... (FUD)

AMEX: FUD

· Real-Time Price · USD

17.38

0.20 (1.16%)

At close: Dec 09, 2020, 9:04 PM

1.16% (1D)

| Bid | - |

| Market Cap | 6.45M |

| AUM | 6.32M |

| NAV | 17.02 |

| EPS (ttm) | 0.00 |

| PE Ratio (ttm) | n/a |

| Shares Out | 371.26K |

| Inception Date | Jan 1, 2009 |

| Ask | - |

| Volume | 1,492 |

| Open | 17.02 |

| Previous Close | 17.18 |

| Day's Range | 17.02 - 17.38 |

| 52-Week Range | 13.63 - 34.11 |

| Holdings | 0 |

| Expense Ratio | 0.65% |

About FUD

The investment seeks to track the price and performance yield, before fees and expenses, of the UBS Bloomberg CMCI Food Total Return index. The fund is designed to be representative of the entire liquid forward curve of each commodity in the index. The index measures the collateralized returns from a diversified basket of agriculture and livestock futures contracts. It is comprised of the 11 agriculture futures contracts and two livestock futures contracts included in the CMCI with three target maturities for each individual commodity.

Asset Class Equity

Ticker Symbol FUD

Inception Date Jan 1, 2009

Provider Other

Website Fund Home Page

Exchange AMEX

5 years ago · seekingalpha.com

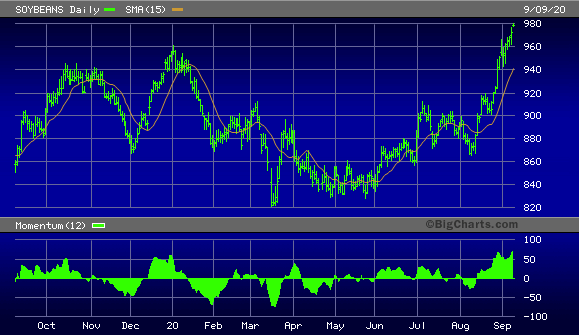

China Woes Boost U.S. Soybean OutlookChina has become a big importer of U.S. grains as food prices soar.