iShares Bloomberg Roll Se... (CMDY)

AMEX: CMDY

· Real-Time Price · USD

52.65

0.06 (0.12%)

At close: Sep 29, 2025, 3:59 PM

52.68

0.06%

After-hours: Sep 29, 2025, 05:43 PM EDT

0.12% (1D)

| Bid | 51.9 |

| Market Cap | 279.24M |

| AUM | 290.13M |

| NAV | 52.75 |

| EPS (ttm) | n/a |

| PE Ratio (ttm) | n/a |

| Shares Out | 5.3M |

| Inception Date | Apr 3, 2018 |

| Ask | 58.28 |

| Volume | 40,965 |

| Open | 52.66 |

| Previous Close | 52.59 |

| Day's Range | 52.58 - 52.76 |

| 52-Week Range | 46.21 - 52.79 |

| Holdings | 56 |

| Expense Ratio | 0.29% |

About CMDY

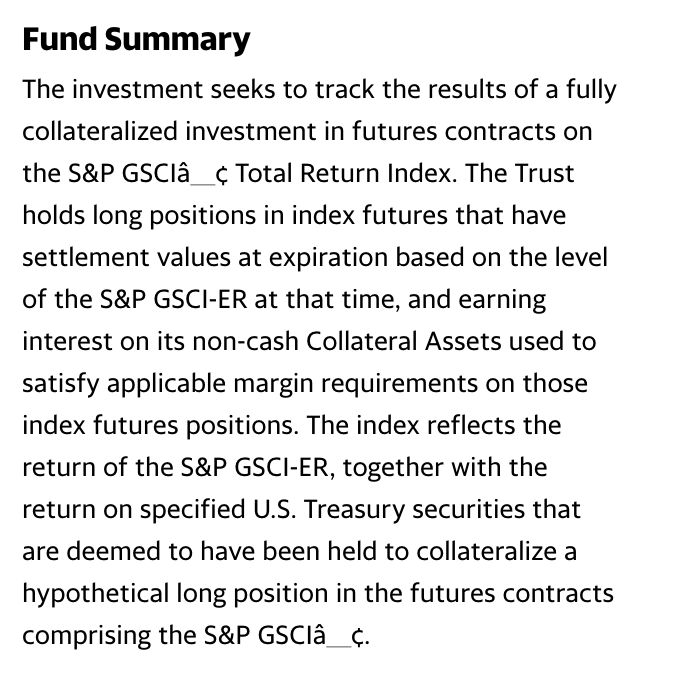

The iShares Bloomberg Roll Select Commodity Strategy ETF (the “Fund”) seeks to track the investment results of an index composed of a broad range of commodity exposures with enhanced roll selection, on a total return basis.

Asset Class Commodity

Ticker Symbol CMDY

Inception Date Apr 3, 2018

Provider Blackrock

Website Fund Home Page

Exchange AMEX

Top 10 Holdings 42.58% of assets

| Name | Symbol | Weight |

|---|---|---|

| Blk Csh Fnd Treasury... | - | 6.62% |

| Treasury Bill | - | 5.39% |

| Treasury Bill | - | 5.38% |

| Treasury Bill | - | 5.36% |

| Cash Collateral Usd ... | - | 4.06% |

| Treasury Bill | - | 3.59% |

| Treasury Bill | - | 3.58% |

| Treasury Bill | - | 3.56% |

| Treasury Bill | - | 3.42% |

| Archer Daniels Midla... | - | 1.62% |

Dividends Dividend Yield 4.29%

| Ex-Dividend | Amount | Payment Date |

|---|---|---|

| Dec 17, 2024 | $2.0114 | Dec 20, 2024 |

| Dec 20, 2023 | $2.3974 | Dec 27, 2023 |

| Dec 13, 2022 | $2.1720 | Dec 19, 2022 |

| Dec 13, 2021 | $7.9620 | Dec 17, 2021 |

| Dec 14, 2020 | $0.0662 | Dec 18, 2020 |

3 years ago · seekingalpha.com

A First Look At The iShares Bloomberg Roll Select Commodity Strategy ETFThe iShares Bloomberg Roll Select Commodity Strategy ETF (CMDY) uses one Futures contract to cover the commodities market. It is designed to minimize contract rolling costs. The Bloomberg Roll Select ...