Direxion Russell Small Ov... (RWSL)

| Bid | - |

| Market Cap | 3.39M |

| AUM | 3.39M |

| NAV | 45.28 |

| EPS (ttm) | 0.00 |

| PE Ratio (ttm) | n/a |

| Shares Out | 74.8K |

| Inception Date | Jan 16, 2019 |

| Ask | - |

| Volume | 2,176 |

| Open | 44.94 |

| Previous Close | 44.64 |

| Day's Range | 44.87 - 45.27 |

| 52-Week Range | 29.58 - 55.52 |

| Holdings | 0 |

| Expense Ratio | 0.59% |

About RWSL

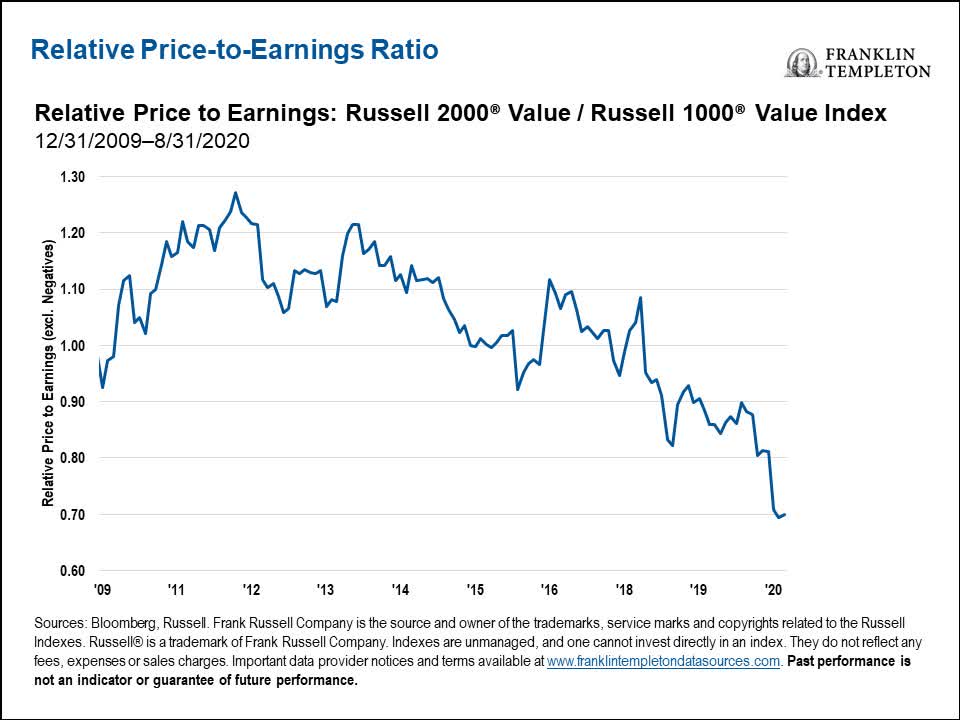

The investment seeks investment results, before fees and expenses, that track the Russell 2000Â/Russell 1000Â 150/50 Net Spread Index (the "index"). The fund, under normal circumstances, invests at least 80% of its net assets (plus borrowing for investment purposes) in securities that comprise the Long Component of the index or shares of exchange-traded funds ("ETFs") on the Long Component of the index. The index measures the performance of a portfolio that has 150% long exposure to the Russell 2000Â Index (the "Long Component") and 50% short exposure to the Russell 1000Â Index (the "Short Component"). The fund is non-diversified.

Top Sectors

| Sector | Weight % |

|---|---|

| Healthcare | 18.24% |

| Industrials | 16.60% |

| Financial Services | 16.23% |

| Technology | 13.15% |

| Consumer Cyclical | 9.76% |

Dividends Dividend Yield 0.41%

| Ex-Dividend | Amount | Payment Date |

|---|---|---|

| Jun 23, 2020 | $0.1840 | n/a |

| Jun 25, 2019 | $0.2430 | n/a |

5 years ago · seekingalpha.com

Industrial Production Gathers SteamIndustrial production rose 3% in July. This followed a rise in May and June.

5 years ago · seekingalpha.com

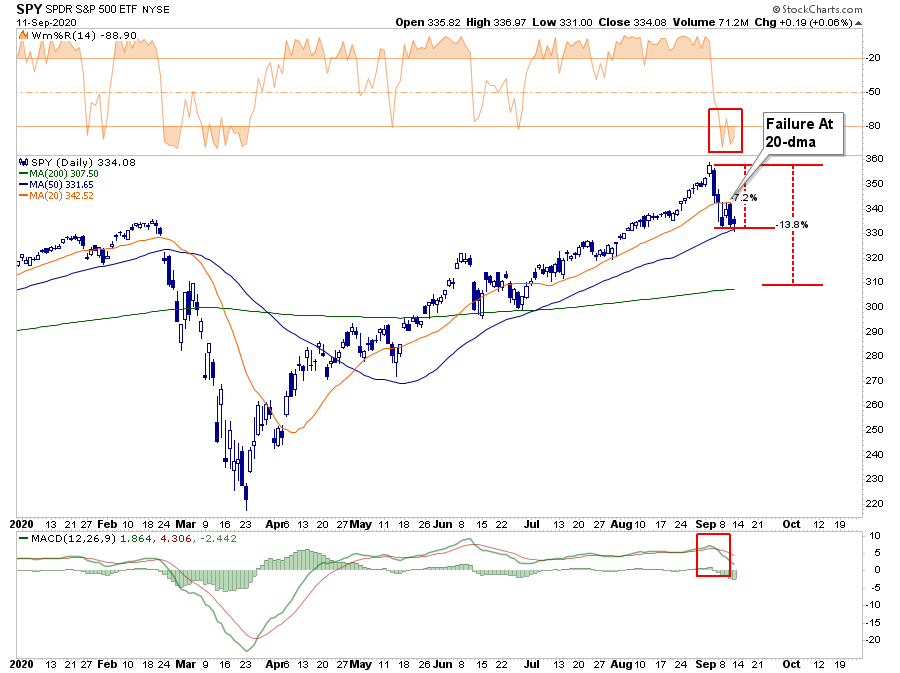

Does Recent Market Volatility Signal A Rotation Away From Tech Stocks?Factors driving the tech-fueled market selloff. U.S.