Hudbay Minerals Inc. (HBM)

NYSE: HBM

· Real-Time Price · USD

15.68

0.23 (1.49%)

At close: Oct 03, 2025, 2:26 PM

1.49% (1D)

| Bid | 15.67 |

| Market Cap | 6.18B |

| Revenue (ttm) | 2.2B |

| Net Income (ttm) | 289.02M |

| EPS (ttm) | 0.74 |

| PE Ratio (ttm) | 21.18 |

| Forward PE | 17.09 |

| Analyst | n/a |

| Dividends | $0.02 |

| Ask | 15.69 |

| Volume | 4,926,223 |

| Avg. Volume (20D) | 7,308,853 |

| Open | 15.68 |

| Previous Close | 15.45 |

| Day's Range | 15.45 - 15.85 |

| 52-Week Range | 5.95 - 15.85 |

| Beta | 2.18 |

| Ex-Dividend Date | Sep 2, 2025 |

Hudbay Minerals Inc. is scheduled to release its earnings on

Nov 12, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

4 days ago

+7.42%

Shares of copper-related stocks are trading higher...

Unlock content with

Pro Subscription

1 week ago

+5.06%

Shares of copper stocks are trading higher in response to Freeport-McMoRan's announcement that two PT Freeport Indonesia team members were fatally injured from the Grasberg Block Cave mine mud rush incident and that five team members remain missing.

1 month ago · seekingalpha.com

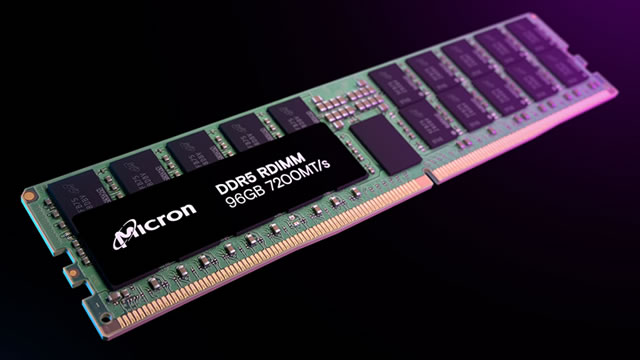

Micron: Time To Jump Back On The AI Bullet Train (Rating Upgrade)I'm upgrading Micron back to a buy from strong sell after management raised guidance, confirming that more favorable DRAM/HBM demand and pricing is at play. Micron is a leader within the High Bandwidt...