Rogers Communications Inc... (RCI)

NYSE: RCI

· Real-Time Price · USD

36.85

0.08 (0.22%)

At close: Oct 15, 2025, 3:59 PM

36.86

0.03%

After-hours: Oct 15, 2025, 04:30 PM EDT

0.22% (1D)

| Bid | 35.28 |

| Market Cap | 19.91B |

| Revenue (ttm) | 20.8B |

| Net Income (ttm) | 1.52B |

| EPS (ttm) | 1.99 |

| PE Ratio (ttm) | 18.52 |

| Forward PE | 10.63 |

| Analyst | Hold |

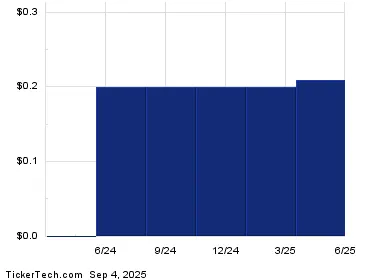

| Dividends | $1.79 |

| Ask | 37.25 |

| Volume | 1,027,115 |

| Avg. Volume (20D) | 1,177,237.7 |

| Open | 36.70 |

| Previous Close | 36.77 |

| Day's Range | 36.58 - 37.17 |

| 52-Week Range | 23.18 - 39.33 |

| Beta | 0.86 |

| Ex-Dividend Date | Sep 8, 2025 |

Analyst Forecast

According to 0 analyst ratings, the average rating for RCI stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsRogers Communications Inc. is scheduled to release its earnings on

Oct 23, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

6 months ago

-3.05%

Shares of companies within the broader communicati...

Unlock content with

Pro Subscription

8 months ago

-3.98%

Rogers Communication shares are trading lower. The company reported Q4 financial results yesterday.

3 weeks ago · seekingalpha.com

RCI Hospitality: Free Cash Flow And Share Buybacks Limit DownsideRCI Hospitality has dipped to form new lows with same-store sales for its adult nightclubs and Bombshells segment negative during its recent third quarter. The company remains highly cash generative w...