Standard Lithium Ltd. (SLI)

AMEX: SLI

· Real-Time Price · USD

4.59

0.08 (1.77%)

At close: Oct 09, 2025, 10:57 AM

1.77% (1D)

| Bid | 4.58 |

| Market Cap | 933.25M |

| Revenue (ttm) | n/a |

| Net Income (ttm) | 166.38M |

| EPS (ttm) | 0.61 |

| PE Ratio (ttm) | 7.52 |

| Forward PE | -19 |

| Analyst | Strong Buy |

| Dividends | n/a |

| Ask | 4.59 |

| Volume | 2,283,892 |

| Avg. Volume (20D) | 2,755,343 |

| Open | 4.72 |

| Previous Close | 4.51 |

| Day's Range | 4.50 - 4.78 |

| 52-Week Range | 1.08 - 4.78 |

| Beta | 1.99 |

| Ex-Dividend Date | n/a |

Analyst Forecast

According to 0 analyst ratings, the average rating for SLI stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock Forecasts34 minutes ago

Shares of lithium-related stocks are trading highe...

Unlock content with

Pro Subscription

22 hours ago

+8.41%

Shares of lithium companies are trading higher amid possible sympathy with an ongoing metal rally. The commodity has seen recent volatility in response to the government shutdown and news regarding the Lithium Americas deal.

2 months ago · seekingalpha.com

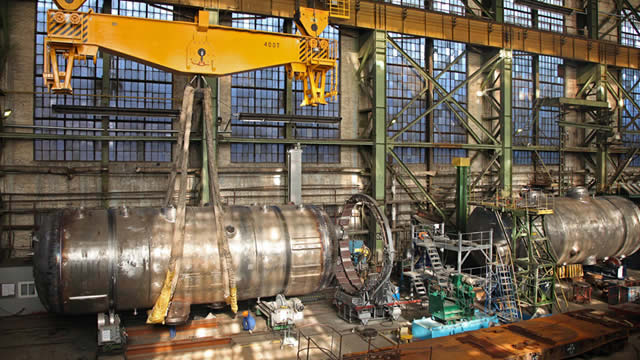

Standard Lithium: Positioned At The Crossroads Of Geology, Tech, And U.S. StrategyStandard Lithium Ltd. offers a unique, tech-driven approach to U.S. lithium production, leveraging partnerships, federal grants, and world-class resources in Arkansas and Texas. The company's direct l...