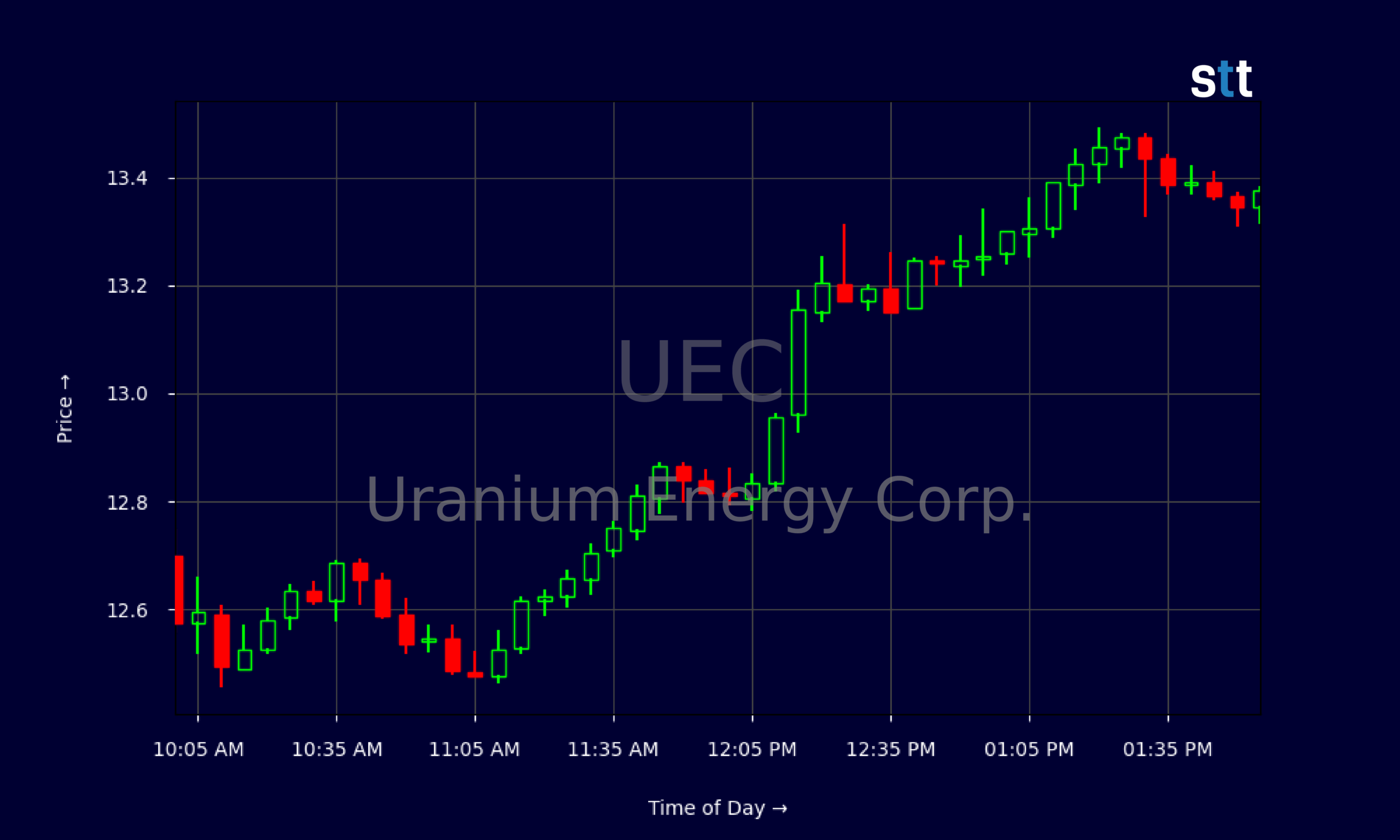

Uranium Energy Corp. (UEC)

AMEX: UEC

· Real-Time Price · USD

16.76

1.10 (7.02%)

At close: Oct 15, 2025, 3:59 PM

16.85

0.54%

After-hours: Oct 15, 2025, 04:27 PM EDT

7.02% (1D)

| Bid | 16.76 |

| Market Cap | 7.8B |

| Revenue (ttm) | 66.84M |

| Net Income (ttm) | -87.66M |

| EPS (ttm) | -0.2 |

| PE Ratio (ttm) | -83.8 |

| Forward PE | -255.25 |

| Analyst | Strong Buy |

| Dividends | n/a |

| Ask | 16.83 |

| Volume | 19,806,075 |

| Avg. Volume (20D) | 16,342,681 |

| Open | 16.84 |

| Previous Close | 15.66 |

| Day's Range | 15.73 - 17.08 |

| 52-Week Range | 3.85 - 17.08 |

| Beta | 1.41 |

| Ex-Dividend Date | n/a |

Analyst Forecast

According to 0 analyst ratings, the average rating for UEC stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsUranium Energy Corp. is scheduled to release its earnings on

Dec 4, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

2 days ago

+4.57%

Shares of uranium and nuclear-linked stocks are tr...

Unlock content with

Pro Subscription

2 weeks ago

-1.75%

Uranium Energy shares are trading lower after BMO Capital downgraded the stock from Outperform to Market Perform.

16 hours ago · seekingalpha.com

Uranium Energy: From Speculation To Production - And Why I'm Still BuyingUranium Energy Corp is now America's largest uranium company by resources, shifting from spot accumulation to true US ISR production. UEC boasts industry-leading efficiency, a robust balance sheet, an...

2 weeks ago · seekingalpha.com

Uranium Energy's Stock Continues To Rise, But Earnings Are Not Keeping UpUranium Energy Corporation (UEC) is downgraded from hold to sell due to an excessive valuation despite ongoing operational progress and sector potential. UEC continues to miss revenue and EPS estimate...