Expro Group N.V. (XPRO)

NYSE: XPRO

· Real-Time Price · USD

12.58

0.22 (1.78%)

At close: Oct 15, 2025, 3:59 PM

12.57

-0.08%

After-hours: Oct 15, 2025, 04:20 PM EDT

1.78% (1D)

| Bid | 12.45 |

| Market Cap | 1.45B |

| Revenue (ttm) | 1.67B |

| Net Income (ttm) | 71.26M |

| EPS (ttm) | 0.61 |

| PE Ratio (ttm) | 20.62 |

| Forward PE | 9.94 |

| Analyst | Hold |

| Dividends | n/a |

| Ask | 12.63 |

| Volume | 806,536 |

| Avg. Volume (20D) | 1,263,723 |

| Open | 12.63 |

| Previous Close | 12.36 |

| Day's Range | 12.39 - 12.85 |

| 52-Week Range | 6.70 - 17.38 |

| Beta | 1.16 |

| Ex-Dividend Date | n/a |

About XPRO

undefined

Industry n/a

Sector n/a

IPO Date n/a

Employees NaN

Stock Exchange n/a

Ticker Symbol XPRO

Website n/a

Analyst Forecast

According to 0 analyst ratings, the average rating for XPRO stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsExpro Group N.V. is scheduled to release its earnings on

Oct 23, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

2 months ago

+32.11%

Expro Group Holdings shares are trading higher aft...

Unlock content with

Pro Subscription

2 months ago · seekingalpha.com

Expro Group Holdings N.V. (XPRO) Q2 2025 Earnings Call TranscriptExpro Group Holdings N.V. (NYSE:XPRO ) Q2 2025 Earnings Conference Call July 29, 2025 11:00 AM ET Company Participants Chad Stephenson - Director of Investor Relations Michael Jardon - President, CEO ...

2 months ago · businesswire.com

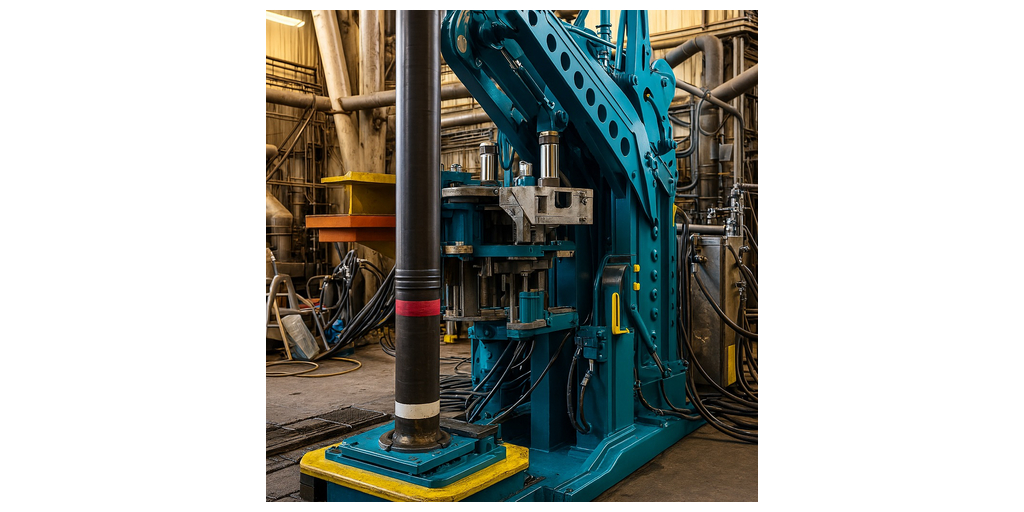

Expro Unveils Its Most Advanced Brute® Packer System for Deepwater WellsHOUSTON--(BUSINESS WIRE)--Expro (NYSE:XPRO), a leading provider of energy services, has launched its most advanced BRUTE® High-Pressure, High Tensile Packer System, designed to help operators work mor...