Consumer Discretionary Se... (XLY)

| Bid | 240.3 |

| Market Cap | 28.96B |

| AUM | 24.11B |

| NAV | 236.27 |

| EPS (ttm) | 7.77 |

| PE Ratio (ttm) | 30.99 |

| Shares Out | 120.25M |

| Inception Date | Dec 16, 1998 |

| Ask | 241.06 |

| Volume | 5,583,041 |

| Open | 240.97 |

| Previous Close | 239.71 |

| Day's Range | 239.25 - 241.55 |

| 52-Week Range | 173.10 - 243.40 |

| Holdings | 50 |

| Expense Ratio | 0.08% |

About XLY

The Consumer Discretionary Select Sector SPDR Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Consumer Discretionary Select Sector Index (the “Index”)The Index seeks to provide an effective representation of the consumer discretionary sector of the S&P 500 IndexSeeks to provide precise exposure to companies in specialty retail; broadline retail; hotels, restaurants and leisure; textiles, apparel and luxury goods; household durables; automobiles; automobile components; distributors; leisure products; and diversified consumer services.Allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing

Top Sectors

| Sector | Weight % |

|---|---|

| Consumer Cyclical | 98.83% |

| Technology | 0.88% |

| Industrials | 0.29% |

Top 10 Holdings 70.62% of assets

| Name | Symbol | Weight |

|---|---|---|

| Amazon.com, Inc. | AMZN | 21.42% |

| Tesla, Inc. | TSLA | 19.92% |

| The Home Depot, Inc. | HD | 6.80% |

| Mcdonald's Corporati... | MCD | 4.37% |

| Booking Holdings Inc... | BKNG | 4.29% |

| The Tjx Companies, I... | TJX | 3.75% |

| Lowe's Companies, In... | LOW | 3.40% |

| Doordash, Inc. | DASH | 2.30% |

| Starbucks Corporatio... | SBUX | 2.26% |

| O'reilly Automotive,... | ORLY | 2.11% |

Dividends Dividend Yield 0.77%

| Ex-Dividend | Amount | Payment Date |

|---|---|---|

| Sep 22, 2025 | $0.4255 | Sep 24, 2025 |

| Jun 23, 2025 | $0.4470 | Jun 25, 2025 |

| Mar 24, 2025 | $0.5420 | Mar 26, 2025 |

| Dec 23, 2024 | $0.4331 | Dec 26, 2024 |

| Sep 23, 2024 | $0.4047 | Sep 25, 2024 |

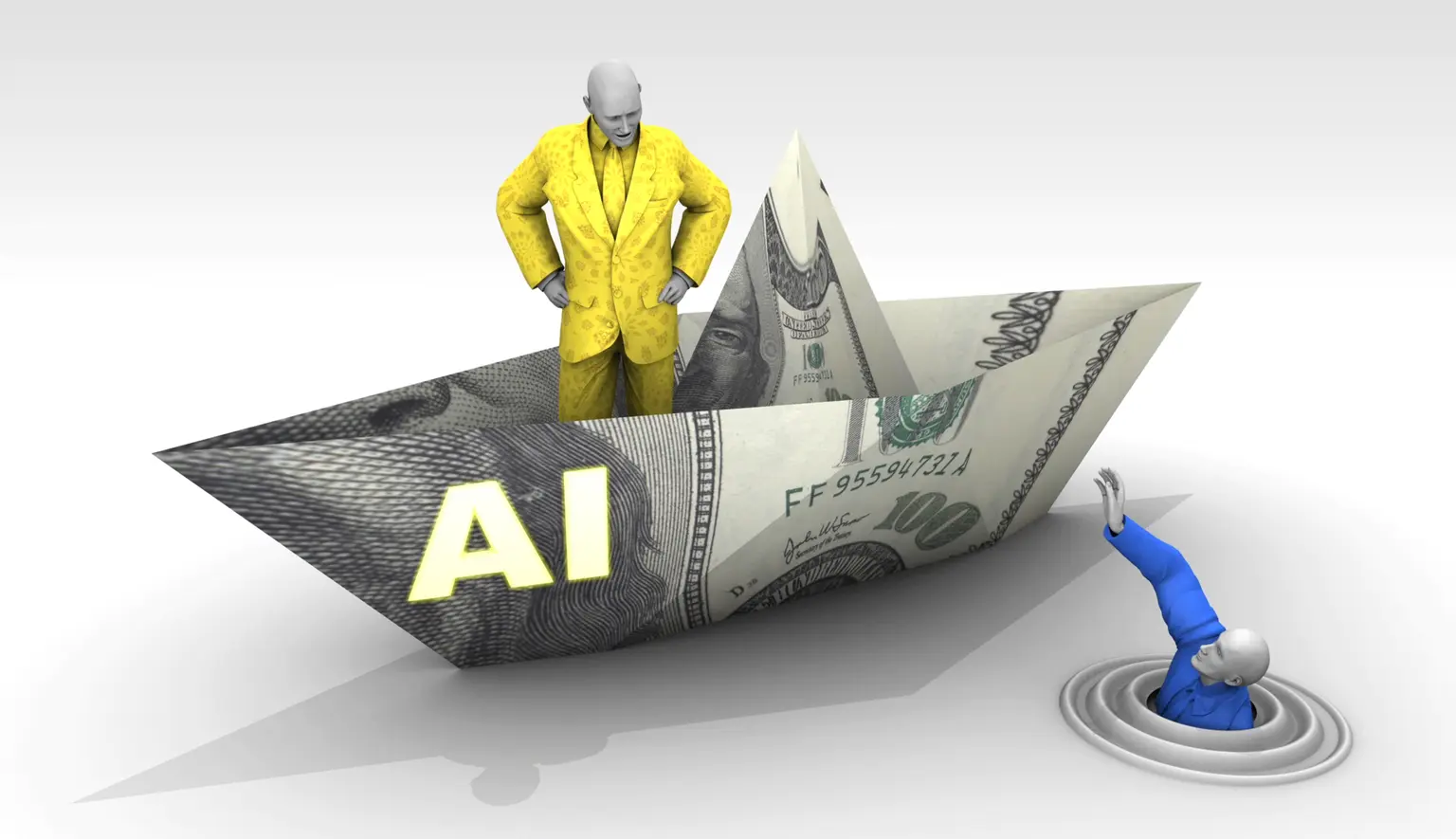

1 month ago · seekingalpha.com

XLY: Don't Expect Consumer Spending To Notably Recover Until 2026XLY has underperformed the S&P 500 in 2025 due to economic uncertainty, high concentration in Amazon and Tesla, and sector-specific headwinds. While Amazon could rebound and McDonald's is relatively r...