ABM Industries (ABM)

NYSE: ABM

· Real-Time Price · USD

46.12

0.00 (0.00%)

At close: Oct 01, 2025, 1:51 PM

0.00% (1D)

| Bid | 46.12 |

| Market Cap | 2.89B |

| Revenue (ttm) | 8.63B |

| Net Income (ttm) | 115.9M |

| EPS (ttm) | 1.86 |

| PE Ratio (ttm) | 24.8 |

| Forward PE | 11.32 |

| Analyst | Strong Buy |

| Dividends | $1.29 |

| Ask | 46.16 |

| Volume | 246,999 |

| Avg. Volume (20D) | 576,135.6 |

| Open | 45.83 |

| Previous Close | 46.12 |

| Day's Range | 45.83 - 46.43 |

| 52-Week Range | 40.85 - 59.15 |

| Beta | 0.80 |

| Ex-Dividend Date | Oct 2, 2025 |

Analyst Forecast

According to 0 analyst ratings, the average rating for ABM stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsABM Industries is scheduled to release its earnings on

Dec 17, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

3 weeks ago

+0.33%

ABM stock has given up its prior loss. ABM Industr...

Unlock content with

Pro Subscription

3 weeks ago

+0.33%

ABM Industries shares are trading lower after the company reported mixed Q3 financial results and narrowed its FY25 adjusted EPS guidance.

20 hours ago · businesswire.com

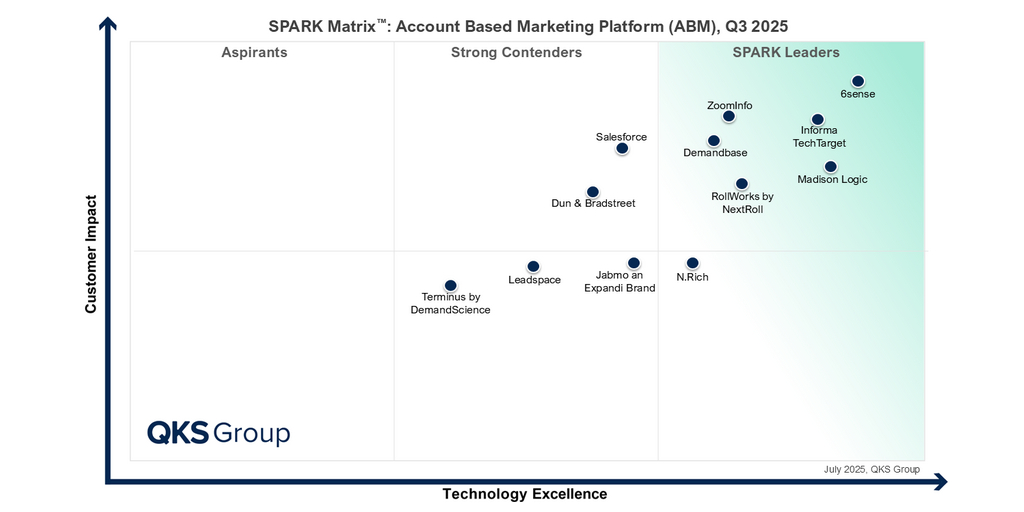

Informa TechTarget Once Again Named a Leader in Account-Based Marketing (ABM) in QKS Group Analyst ReportNEWTON, Mass.--(BUSINESS WIRE)--Informa TechTarget announces it has once again been named a Leader in QKS Group's SPARK Matrix for Account-Based Marketing Platforms, Q3, 2025.

3 weeks ago · seekingalpha.com

ABM Industries Incorporated (ABM) Q3 2025 Earnings Call TranscriptABM Industries Incorporated (NYSE:ABM ) Q3 2025 Earnings Call September 5, 2025 8:30 AM EDT Company Participants Paul Goldberg - Senior Vice President of Investor Relations Scott Salmirs - President, ...