Aurora Cannabis Inc. (ACB)

NASDAQ: ACB

· Real-Time Price · USD

5.29

-0.34 (-6.04%)

At close: Oct 16, 2025, 3:59 PM

5.32

0.57%

After-hours: Oct 16, 2025, 07:54 PM EDT

-6.04% (1D)

| Bid | 5.21 |

| Market Cap | 297.58M |

| Revenue (ttm) | 343.29M |

| Net Income (ttm) | 1.59M |

| EPS (ttm) | -0.04 |

| PE Ratio (ttm) | -132.25 |

| Forward PE | 549 |

| Analyst | n/a |

| Dividends | n/a |

| Ask | 5.33 |

| Volume | 1,185,163 |

| Avg. Volume (20D) | 1,760,010 |

| Open | 5.63 |

| Previous Close | 5.63 |

| Day's Range | 5.27 - 5.73 |

| 52-Week Range | 3.42 - 6.91 |

| Beta | 3.26 |

| Ex-Dividend Date | n/a |

Aurora Cannabis Inc. is scheduled to release its earnings on

Nov 5, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

6 days ago

-13.68%

Shares of cannabis-linked stocks are trading lower...

Unlock content with

Pro Subscription

1 week ago

+0.66%

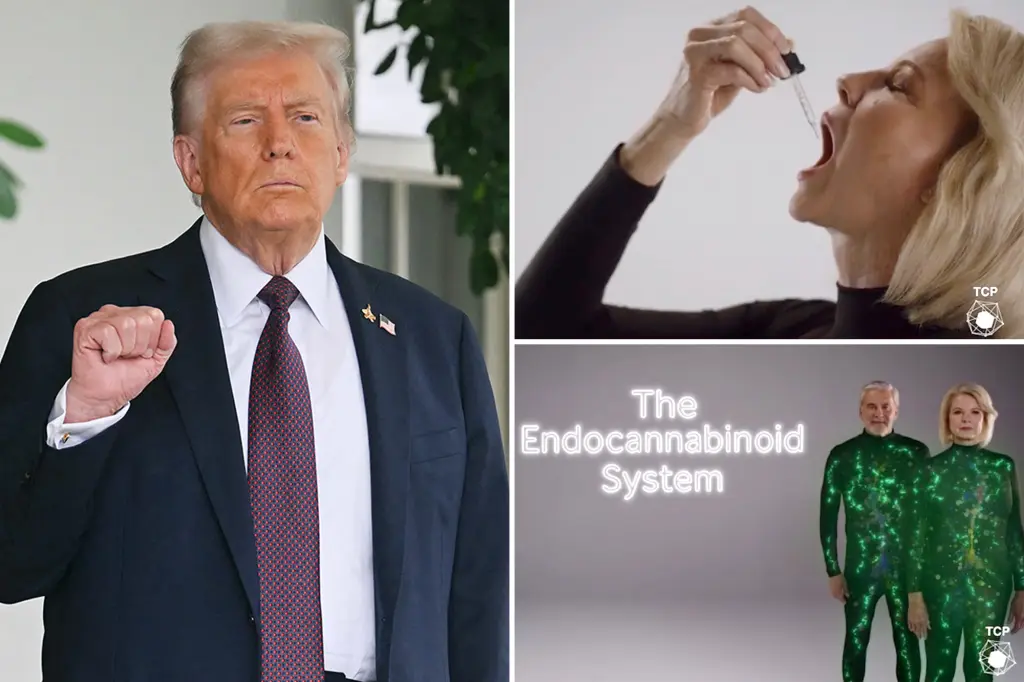

Shares of cannabis-linked stocks are trading higher amid continued strength in the sector from President Trump endorsing the use of CBD for seniors as well as a strong Q3 earnings report from Tilray Brands.

16 hours ago · marijuanastocks.com

3 Canadian Cannabis Stocks to Watch as U.S. Legalization Gains Steam in 2025The Canadian cannabis market continues to play a crucial role in the global marijuana industry. As U.S. legalization efforts gain traction, Canadian producers are positioning themselves for renewed gr...

4 weeks ago · marijuanastocks.com

Best Cannabis Stocks in Canada to Watch Now: Technical Signals and Market OutlookThe Canadian cannabis sector remains a focus for investors as September trading continues. Market leaders are working to expand operations while positioning for long-term growth. Meanwhile, the U.S. c...