Banco Macro S.A. (BMA)

NYSE: BMA

· Real-Time Price · USD

52.74

-0.26 (-0.49%)

At close: Oct 16, 2025, 3:59 PM

53.79

1.99%

After-hours: Oct 16, 2025, 06:52 PM EDT

-0.49% (1D)

| Bid | 51.04 |

| Market Cap | 3.37B |

| Revenue (ttm) | 4,643.5B |

| Net Income (ttm) | 32.53B |

| EPS (ttm) | 4.19 |

| PE Ratio (ttm) | 12.59 |

| Forward PE | 0.01 |

| Analyst | Buy |

| Dividends | $1.44 |

| Ask | 54.42 |

| Volume | 462,544 |

| Avg. Volume (20D) | 627,046 |

| Open | 53.11 |

| Previous Close | 53.00 |

| Day's Range | 51.72 - 54.20 |

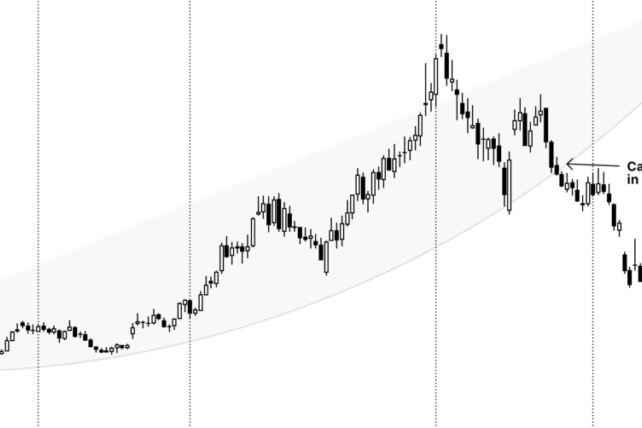

| 52-Week Range | 38.30 - 118.42 |

| Beta | 0.50 |

| Ex-Dividend Date | Oct 20, 2025 |

Analyst Forecast

According to 0 analyst ratings, the average rating for BMA stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsBanco Macro S.A. is scheduled to release its earnings on

Nov 26, 2025,

after market closes.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

1 day ago

+4.21%

Shares of Argentina-linked stocks are trading high...

Unlock content with

Pro Subscription

2 days ago

-4.24%

Shares of Argentina-linked stocks are trading lower. President Trump said if Milei doesn't win, we would not be generous to Argentina.

2 weeks ago · seekingalpha.com

26 Ideal 'Safer' MoPay October Dividend Equities And 80 Funds To BuyOctober's top monthly dividend stocks offer high yields, with many providing annual dividends from $1,000 invested exceeding share prices, but carry volatility risks. Banco Macro, ARMOUR Residential, ...