Polaris Inc. (PII)

NYSE: PII

· Real-Time Price · USD

65.97

-3.93 (-5.62%)

At close: Oct 15, 2025, 3:59 PM

65.99

0.03%

After-hours: Oct 15, 2025, 04:10 PM EDT

-5.62% (1D)

| Bid | 65.57 |

| Market Cap | 3.71B |

| Revenue (ttm) | 6.87B |

| Net Income (ttm) | -107.8M |

| EPS (ttm) | -1.89 |

| PE Ratio (ttm) | -34.9 |

| Forward PE | 59.59 |

| Analyst | Hold |

| Dividends | $3.33 |

| Ask | 66.8 |

| Volume | 1,448,342 |

| Avg. Volume (20D) | 1,593,963.6 |

| Open | 70.14 |

| Previous Close | 69.90 |

| Day's Range | 65.31 - 71.25 |

| 52-Week Range | 30.92 - 84.08 |

| Beta | 1.08 |

| Ex-Dividend Date | Sep 2, 2025 |

Analyst Forecast

According to 0 analyst ratings, the average rating for PII stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsPolaris Inc. is scheduled to release its earnings on

Oct 28, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

1 day ago

+13.92%

Polaris shares are trading higher after the compan...

Unlock content with

Pro Subscription

2 days ago

+8.99%

Polaris shares are trading higher after the company announced it will divest its majority stake in Indian Motorcycle to Carolwood.

6 hours ago · proactiveinvestors.com

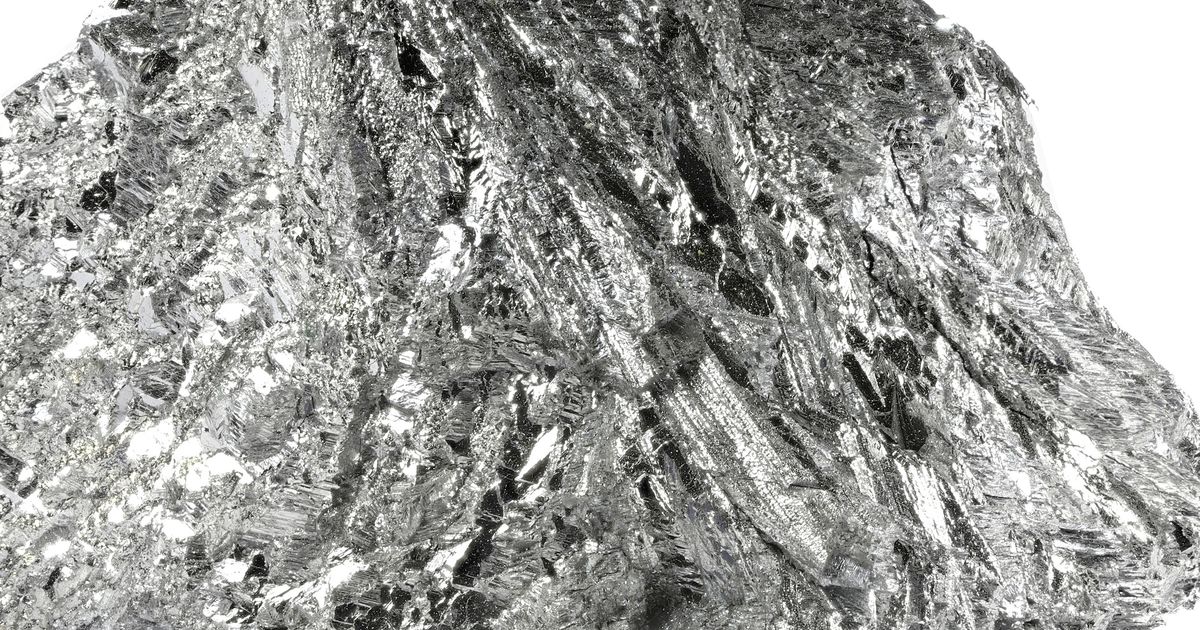

Canagold Resources adds to executive team to advance New PolarisCanagold Resources Ltd (TSX:CCM, OTCQB:CRCUF) has appointed Collen Middleton as vice president of permitting and compliance to support its New Polaris project. Middleton, a registered professional bio...

2 weeks ago · proactiveinvestors.com

Canagold Resources reveals high grade antimony-gold results from concentrate testing at New Polaris project in BCCanagold Resources Ltd (TSX:CCM, OTCQB:CRCUF) announced what it called “positive” results from antimony (Sb) flotation testing at its 100% owned New Polaris gold-antimony project in British Columbia. ...