Talen Energy Corporation (TLN)

NASDAQ: TLN

· Real-Time Price · USD

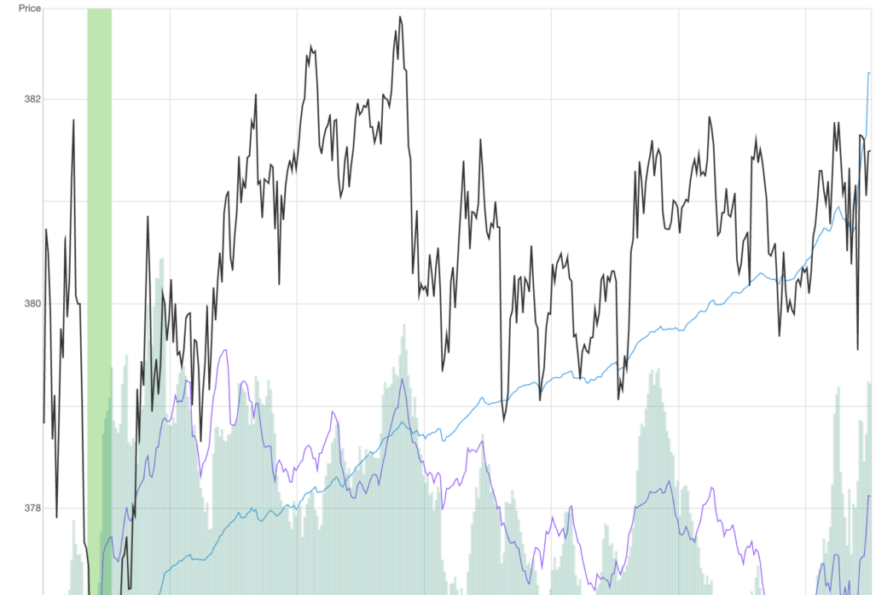

438.50

4.43 (1.02%)

At close: Oct 03, 2025, 3:59 PM

445.00

1.48%

After-hours: Oct 03, 2025, 07:27 PM EDT

1.02% (1D)

| Bid | 438.5 |

| Market Cap | 20.03B |

| Revenue (ttm) | 2.3B |

| Net Income (ttm) | 187M |

| EPS (ttm) | 4.01 |

| PE Ratio (ttm) | 109.35 |

| Forward PE | 21.21 |

| Analyst | Buy |

| Dividends | n/a |

| Ask | 450.67 |

| Volume | 821,258 |

| Avg. Volume (20D) | 1,114,619 |

| Open | 437.93 |

| Previous Close | 434.07 |

| Day's Range | 431.14 - 451.28 |

| 52-Week Range | 148.02 - 451.28 |

| Beta | 1.59 |

| Ex-Dividend Date | n/a |

Analyst Forecast

According to 0 analyst ratings, the average rating for TLN stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsTalen Energy Corporation is scheduled to release its earnings on

Nov 13, 2025,

before market opens.

Analysts project revenue of ... Unlock content with Pro Subscription

Analysts project revenue of ... Unlock content with Pro Subscription

3 weeks ago

+3.39%

Talen Energy shares are trading higher after Morga...

Unlock content with

Pro Subscription

1 month ago

+6.54%

Talen Energy shares are trading higher after the company will replace Interactive Brokers Group in the S&P MidCap 400 effective prior to the opening of trading on Thursday, August 28.

1 month ago · benzinga.com

Talen Energy Shares Up 1.6% After Key Trading SignalTLN reverses early decline after alert

1 month ago · zacks.com

3 Alternative Energy Stocks to Watch Amid Impacts of Policy ShiftAbout the Industry