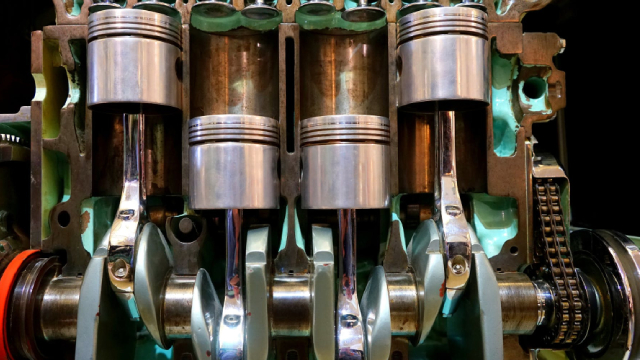

Cummins Inc. (CMI)

| Bid | 435.71 |

| Market Cap | 60.09B |

| Revenue (ttm) | 33.72B |

| Net Income (ttm) | 2.94B |

| EPS (ttm) | 21.32 |

| PE Ratio (ttm) | 20.45 |

| Forward PE | 16.94 |

| Analyst | Buy |

| Dividends | $9.28 |

| Ask | 436.29 |

| Volume | 557,110 |

| Avg. Volume (20D) | 919,511.1 |

| Open | 432.52 |

| Previous Close | 432.59 |

| Day's Range | 429.17 - 437.43 |

| 52-Week Range | 260.02 - 437.43 |

| Beta | 1.01 |

| Ex-Dividend Date | Aug 22, 2025 |

Analyst Forecast

According to 0 analyst ratings, the average rating for CMI stock is "n/a." The 12-month stock price forecast is $n/a, which is a decrease of 0% from the latest price.

Stock ForecastsAnalysts project revenue of ... Unlock content with Pro Subscription

1 month ago · seekingalpha.com

AI Isn't A Bubble. It's A $100 Trillion Tailwind For My PortfolioI don't see an AI bubble. The $100T transformation ahead is real, with bottlenecks like power and data centers driving lasting demand. Big Tech may dominate headlines, but the real opportunity lies in...

1 month ago · seekingalpha.com

The Only 2 Places I'd Put Big Money For Income And Growth Right NowI hunt investments that combine safety, income, and growth, avoiding hype and focusing on long-term, high-quality opportunities. Some areas are unloved and undervalued, offering income, potential grow...

1 month ago · seekingalpha.com

Cummins Looks Fully Priced To Me, Even After Beating ExpectationsCummins Inc. is at a crossroads, balancing legacy diesel engines with growth in Power Systems and Distribution, but core engine business faces significant cyclical and structural headwinds. Q2 results...